⭐ Real Estate Financial Modeling – Full Practical Course

🌟 Master Real Estate Financial Modeling from Zero to Professional Level

This course is designed to take you from the absolute basics to building a complete, professional real estate financial model—step by step, with real projects, practical tools, and zero complexity.

You don’t need any prior modeling experience. All you need is basic accounting knowledge, and we guide you through everything else.

Whether you work in real estate development, investment, finance, consulting, or simply want a high-demand skill with excellent salaries—this course provides exactly what the market is looking for.

🎯 What You Will Learn

1. 🏗️ Foundations of Real Estate Financial Modeling

•📈 Why REFM is one of the most in-demand skills

•🧩 How financial models drive decisions across real estate firms, investment funds, and banks

•🏛️ The role of modeling in acquisitions, feasibility, and development

2. 🧮 Build a Full Real Estate Financial Model from Scratch

You will learn how to answer real investment questions such as:

•🏞️ Should we buy this land or not?

•💹 Is this project profitable?

•💰 What is the ROI?

•🏦 How much financing is required?

•⚖️ When does the project break even?

Every lesson includes practical steps and real project data so you can build your own model confidently.

🧠 Course Structure (10 Comprehensive Units)

Unit 1 — 📘 Introduction to REFM

Fundamentals and how financial models are applied in real projects.

Unit 2 — 🔄 Project Lifecycle & Core Variables

Understand the full development cycle and what drives project success.

Unit 3 — 💵 Modeling Sales & Revenue

Forecast absorption, pricing, sales pace, and revenue accurately.

Unit 4 — 🏗️ Project Costs & Construction Modeling

Model construction timelines, cost categories, and operating expenses.

Unit 5 — 🏦 Loan & Financing Structure

Bank loans, equity contribution, debt schedules, and financing cost.

Unit 6 — 📊 Measuring Profitability (IRR, NPV, ROI, CAP Rate)

Master the most important investment metrics used by professionals.

Unit 7 — 🔍 Scenario Analysis & Valuation

Analyze best-case, worst-case, and base-case scenarios.

Unit 8 — 🖥️ Building an Investor-Ready Model

Design, layout, and present your model to investors or management.

Unit 9 — 🧱 Full Case Study

A complete project modeled from start to finish.

Unit 10 — 📚 Glossary & Key Formulas

All essential real estate formulas and financial modeling terms.

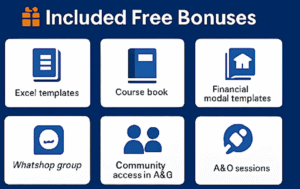

🎁 Included Free Bonuses

•📊 Excel templates for every module

•📕 Full course book

•🗂️ Ready-to-use financial model templates

•💬 Private WhatsApp support group

•👥 Community access with tasks, discussions, activities

•❓ A&Q sessions with the instructor

All bonuses are 100% free with your enrollment.

👨🏫 Meet Your Instructor — Mohamed Khalifa CMA®, FMVA®

With over 13 years of experience in finance & real estate and more than 7,500 trainees, Mohamed brings deep practical expertise to the course.

Professional Background

•🧭 CFO — Abo Elfeda

•🏦 Finance Officer — Ijarah (Saudi Arabia)

•🌍 International training experience for CFA®, CMA®, FMVA®

•📈 Expertise in portfolio monitoring, cost strategy, profitability, and development feasibility

💰 Pricing (Limited Seats)

Prices based on enrollment order:

•🥇 First 100 students: 5,000 EGP (+ exclusive gift)

•🥈 Students 101–200: 7,000 EGP

•🥉 Students 201+ : 10,000 EGP

🔒 Normal Price: 10,000 EGP

📅 Access Duration: 1 full year

🚀 Who Is This Course For?

Perfect for:

•🏘️ Real estate professionals

•📊 Financial analysts & investment teams

•🏗️ Developers & feasibility analysts

•🏦 Bank analysts

•🎓 Students preparing for CFA®, FMVA®, or finance careers

•💡 Anyone who wants to build real, professional financial models

No prior modeling experience needed.