price

EGP440

- 50 Hours of professional training

- Complete PDF course books

- Question Bank

- Two year Access

💼 What’s Inside Your All-in-One Success Kit?

This is practical, results-driven learning — designed to help you pass the exam and thrive in the real world.

- 50 Hours of Video Lectures — Clear, engaging, and packed with real-world context

- Downloadable PDF Books — Review anytime, anywhere

- 1,314-Question Bank — Drill your way to mastery with exam-style questions

Watch a Free Lecture

Course Curriculum

Financial Statement Analysis

1. Perform vertical & horizontal analysis, common-size statements, growth rates, and identify trends in financial statements. 2. Use liquidity ratios to assess short-term ability to meet obligations. 3. Analyze leverage/solvency and how debt vs. equity affects risk using coverage and leverage ratios. 4. Measure efficiency (turnover, operating/cash cycles) and profitability/market performance (margins, ROA/ROE, P/E, EPS). 5. Understand ratio limitations and the impact of FX, inflation, accounting changes, and earnings quality on results.

Corporate Finance

1. Understand risk & return: calculate returns, types of risk, diversification, beta, and CAPM expected return. 2. Master long-term finance: bonds/stocks valuation (DCF), duration, derivatives, inflation–rates link, WACC & cost of capital for investment decisions. 3. Know how firms raise capital: market efficiency, credit ratings, investment banking, IPOs/offerings, leasing, dividends, share buybacks, debt vs equity. 4. Manage working capital: cash forecasting/collection tools, marketable securities, receivables/credit policy, inventory concepts (JIT/EOQ), short-term financing costs. 5. Cover restructuring & international finance: M&A/LBOs/defenses/divestitures + FX drivers, hedging with futures/swaps/options, and international diversification.

Decision Analysis

1. CVP (Breakeven) analysis: classify fixed vs variable costs, compute contribution margin, breakeven, target profit, margin of safety, sales mix effects, and include taxes/sensitivity. 2. Calculate operating income at different volumes and use CVP results to recommend decisions. 3. Marginal/relevant analysis: identify relevant vs sunk costs, opportunity cost, marginal cost/revenue, and apply to special orders, make-or-buy, drop/add, process further decisions (with taxes + qualitative factors). 4. Pricing methods: cost-based, market-based, and value-based pricing; calculate prices and understand demand/supply impact. 5. Use economics + strategy in pricing: market structures (competition→monopoly), elasticity, target costing/value engineering, short vs long-term pricing, and product life cycle pricing.

Enterprise Risk Management

1. Understand types of risk (business, hazard, financial, operational, strategic + legal/compliance/political) and how volatility/time affect risk. 2. Measure risk using probabilities (expected loss) and know unexpected loss vs maximum possible loss + capital adequacy (solvency/liquidity/reserves). 3. Apply risk responses: avoid, retain, reduce/mitigate, transfer/share (insurance/debt), or accept/exploit, and distinguish inherent vs residual risk. 4. Use risk management process & tools: qualitative (ranking, risk maps) and quantitative (cash flow/earnings/EPS at risk, distributions, VaR concept). 5. Know ERM framework: objectives/benefits, event identification, integration with governance/internal controls, COSO ERM, and recommend mitigation using cost–benefit analysis.

Capital Investment Decisions

1. Understand the capital budgeting process and how to plan, approve, and implement investment projects. 2. Compute relevant incremental cash flows (pre-tax & after-tax), including taxes, inflation, and changes in net working capital (not accounting profit). 3. Know hurdle rate/discount rate and how to adjust for risk using sensitivity, scenario, and Monte Carlo analysis. 4. Use DCF methods: calculate and interpret NPV & IRR, compare them (independent vs mutually exclusive projects + multiple IRR issue). 5. Apply supporting methods: payback/discounted payback, profitability index, real options (delay/expand/abandon), and post-audit + qualitative factors.

Professional Ethics

1. Know core business ethics concepts (fairness, integrity, due diligence, fiduciary duty) and common types of fraud. 2. Understand the IMA Statement of Ethical Professional Practice (principles + standards) and apply it to real ethical dilemmas. 3. Use the fraud triangle (pressure, opportunity, rationalization) to identify and manage fraud risk. 4. Focus on organizational ethics: culture, code of conduct, internal controls, groupthink vs diversity of thought, and “tone at the top.” 5. Cover compliance & responsibility: ethical vs legal behavior, anti-bribery laws, whistleblowing, sustainability/social responsibility, and data ethics/privacy.

Who This Course Is For

CMA candidates ready to pass with confidence

Finance professionals targeting leadership and promotion

Anyone ready to go from accountant to strategic advisor

Meet Your Instructor

Instructor Mohamed Khalifa

- CMA®, FMVA® Holder

- Over 13 years of hands-on experience in finance

- 7,500+ trainees

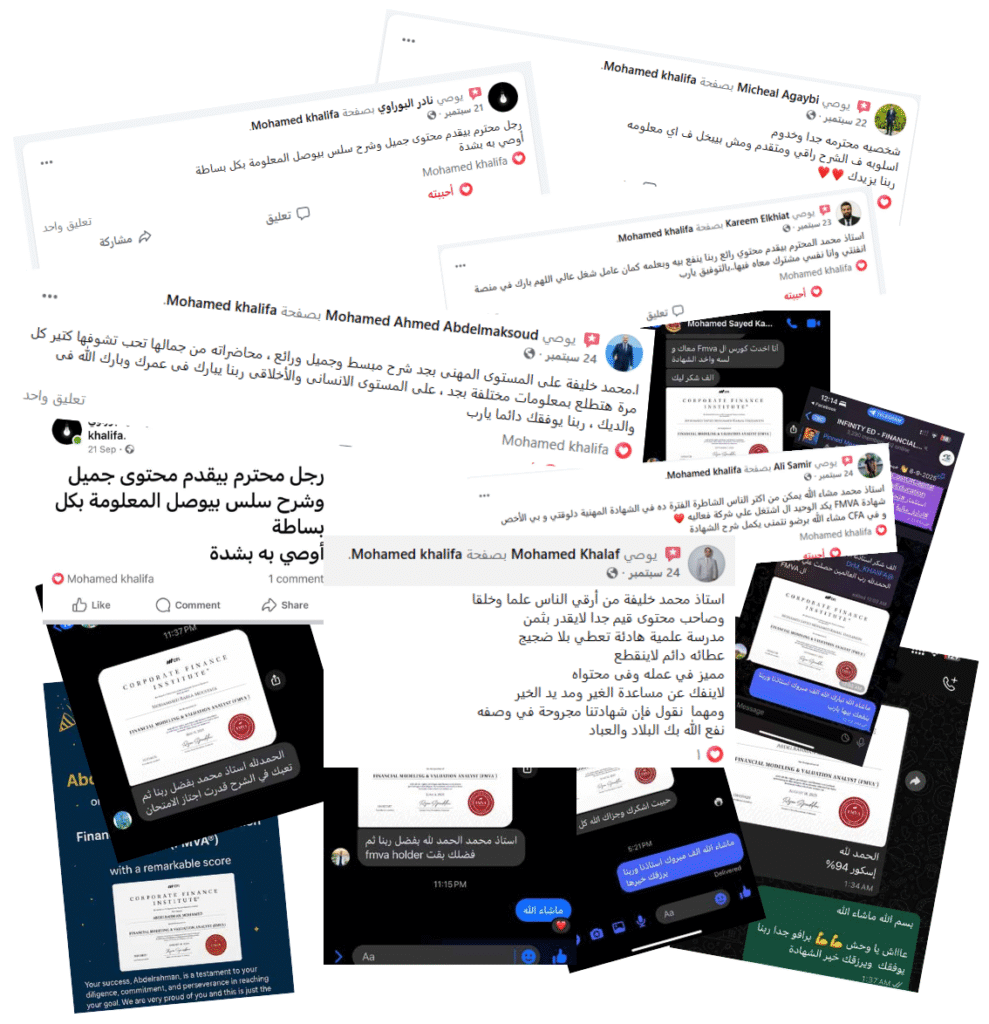

What Students Say