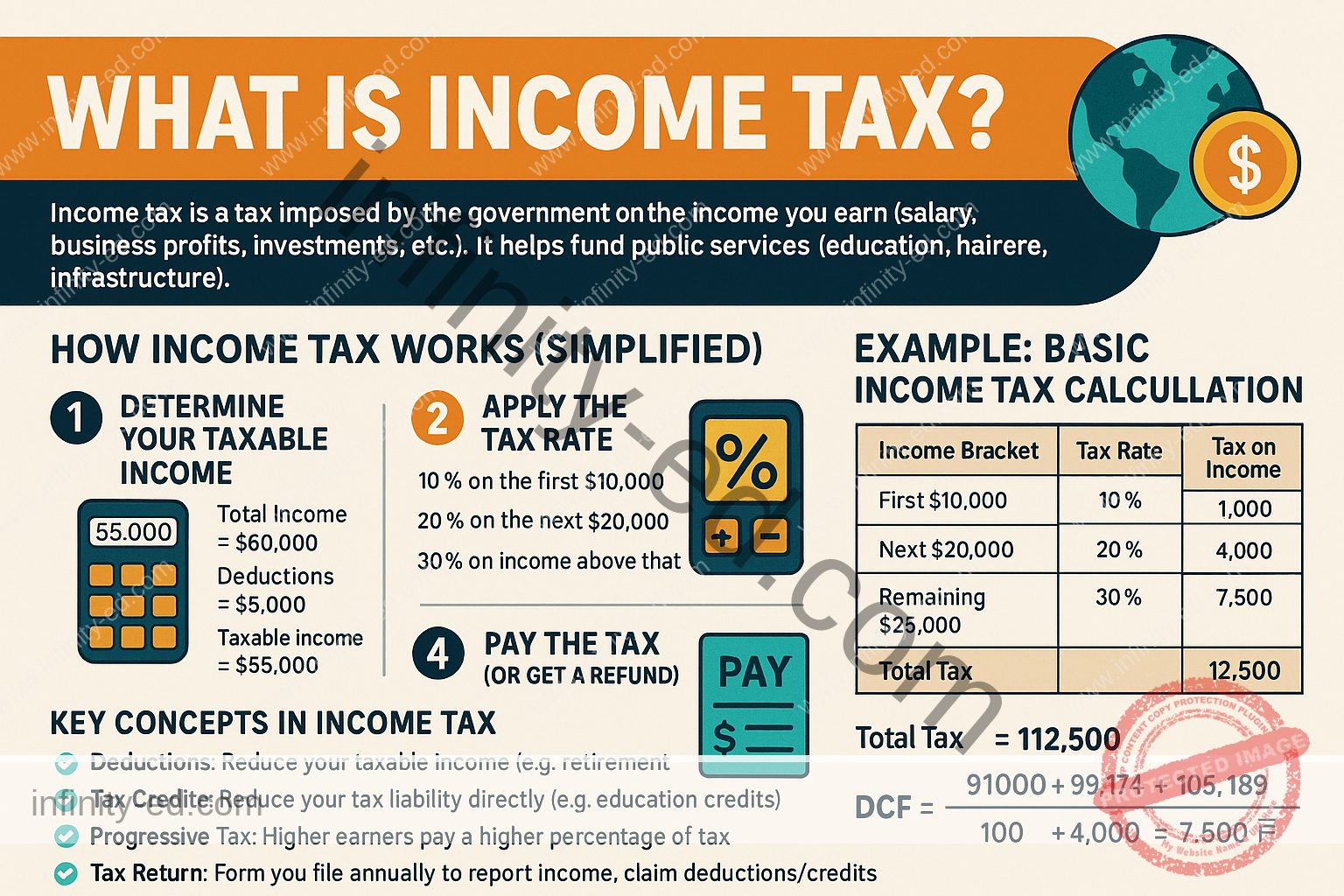

🌍 What is Income Tax?

Income tax is a tax imposed by the government on the income you earn. This income could come from:

-

Your salary or wages (employment income)

-

Business profits

-

Investments (like interest, dividends, capital gains)

-

Rent from properties

-

Other sources

Income tax is typically used by governments to fund public services such as education, healthcare, defense, and infrastructure.

💡 How Income Tax Works (Simplified)

1️⃣ Determine Your Taxable Income

This is your total income minus allowable deductions and exemptions.

Example:

Total income = $60,000

Deductions (like retirement contributions) = $5,000

Taxable income = $55,000

2️⃣ Apply the Tax Rate

Governments use tax brackets (also called slabs or bands). The more you earn, the higher the tax rate on that portion of income.

For example (simplified):

-

10% on the first $10,000

-

20% on the next $20,000

-

30% on income above that

3️⃣ Calculate Your Tax

Apply the rates to each bracket of your income.

4️⃣ Pay the Tax (or Get a Refund)

Your employer may withhold tax from your paycheck, or you may pay directly. If you overpay, you get a refund!

🔑 Key Concepts in Income Tax

✅ Deductions: Reduce your taxable income (e.g., retirement savings, mortgage interest).

✅ Tax Credits: Reduce your tax liability directly (e.g., education credits, child tax credit).

✅ Progressive Tax: Higher earners pay a higher percentage of tax.

✅ Tax Return: The form you file annually to report income and claim deductions/credits.

📝 Example: Basic Income Tax Calculation

| Income Bracket | Tax Rate | Tax on Income |

|---|---|---|

| First $10,000 | 10% | $1,000 |

| Next $20,000 | 20% | $4,000 |

| Remaining $25,000 | 30% | $7,500 |

Total Tax = $1,000 + $4,000 + $7,500 = $12,500