price

EGP10,000

- 20 Hours of professional training

- Complete PDF course books

- Excel financial model

- One year Access

What You’ll Master in This Course

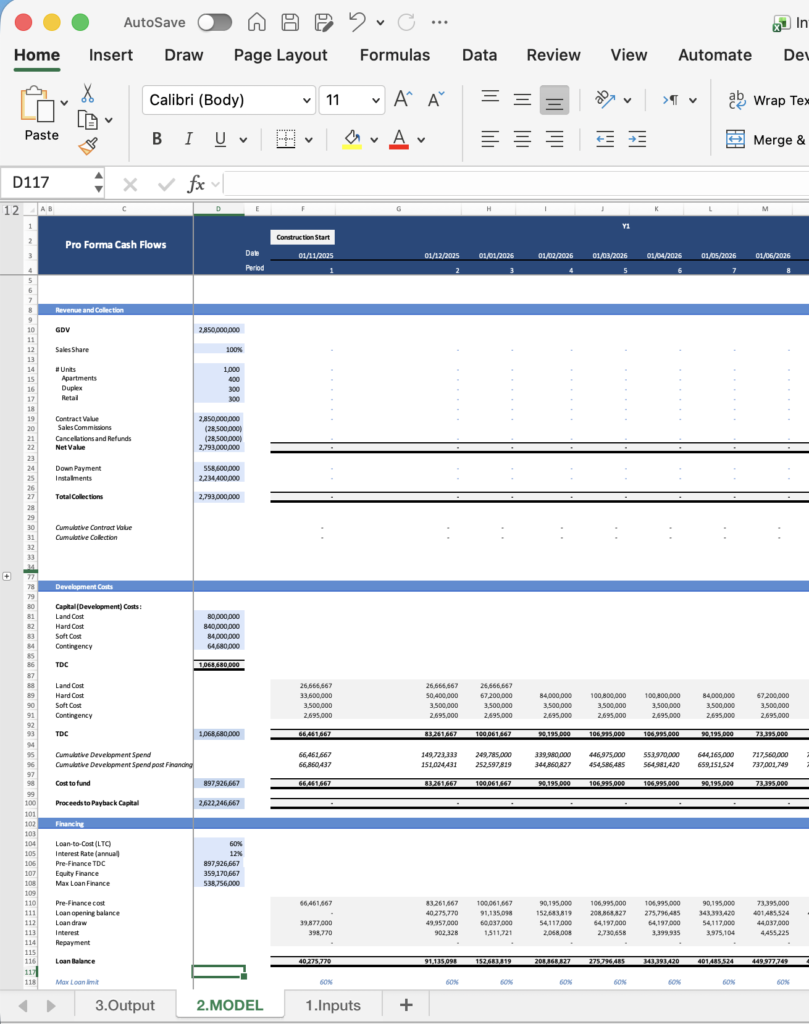

- Build complete real estate financial models from scratch

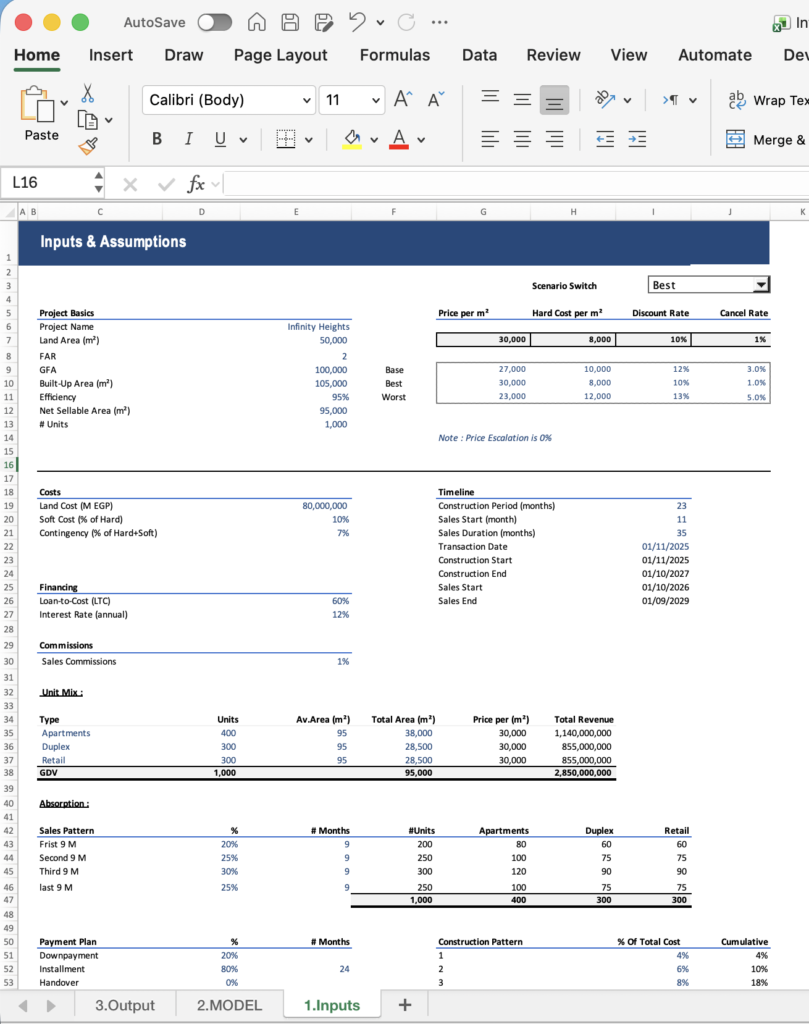

- Structure professional assumptions used by institutions

- Model revenues, operating costs, and cash flows accurately

- Analyze IRR, NPV, Equity Multiple like an investor

- Perform sensitivity & scenario analysis for real decisions

- Understand how banks and funds evaluate deals

Photos from the course

Course Curriculum

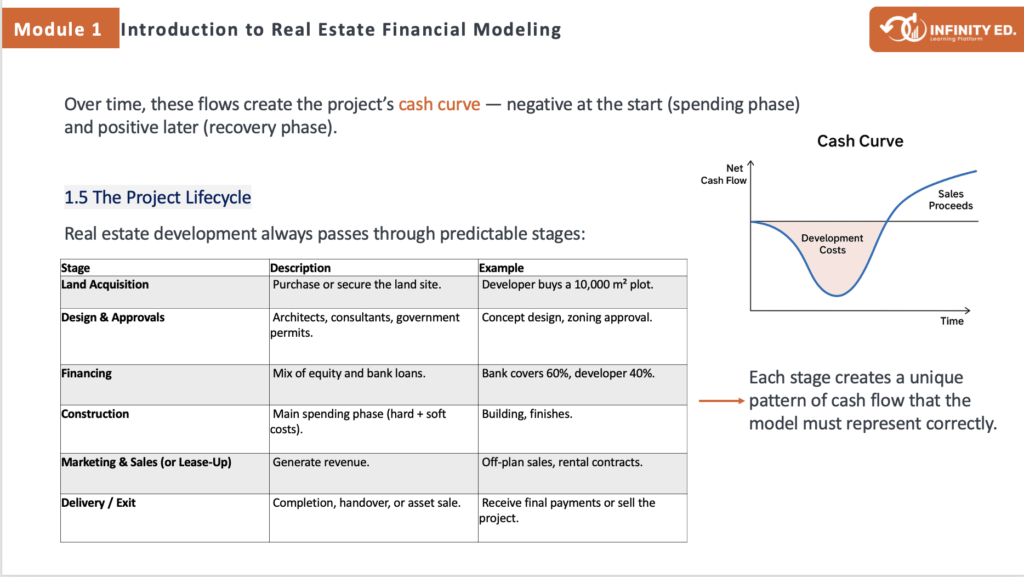

Introduction to Real Estate Financial Modeling

Understand real estate financial modeling as a decision-making tool, not just Excel formulas. You’ll learn why models are built and how investors actually use them.

Project lifecycle & core variables

Analyze the full real estate project lifecycle — from land acquisition to exit — and understand how each phase impacts cash flow, risk, and returns.

Revenue & sales modeling

Model pricing strategies, absorption rates, payment plans, and convert booked sales into real cash collections.

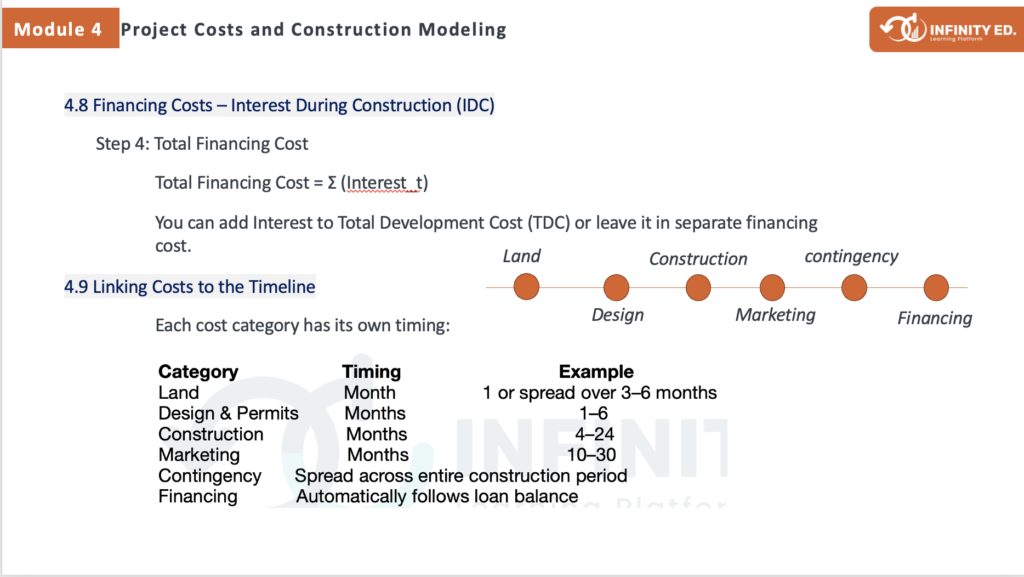

Cost & construction modeling

Build construction cost models using phasing & S-curves, and understand how to control cost overrun risk.

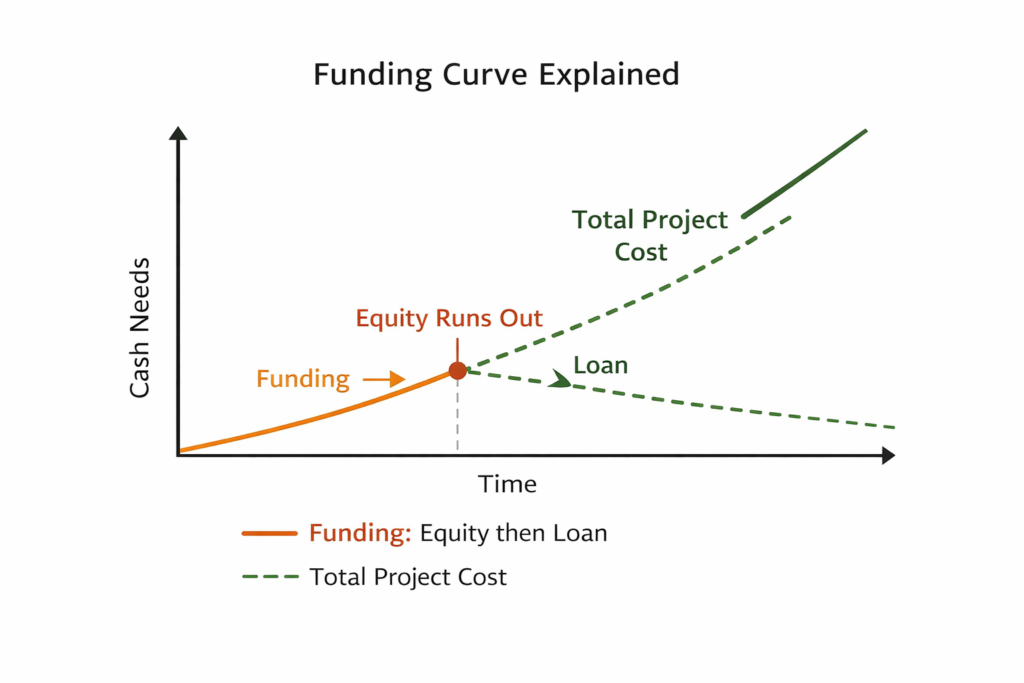

Financing structure & loan modeling

Model bank loans, drawdowns, repayments, and calculate Interest During Construction (IDC) correctly.

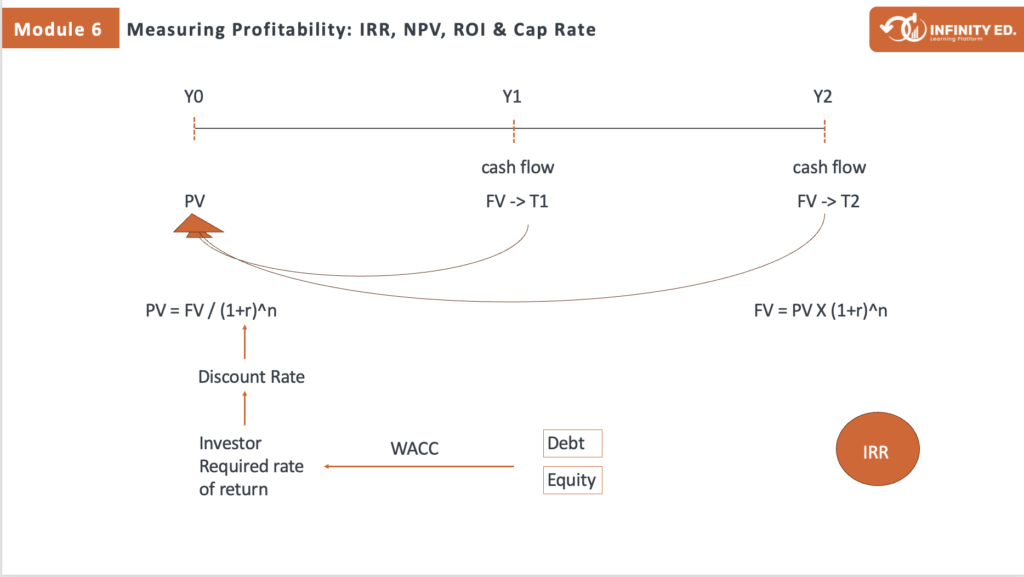

Measuring profitability (IRR, NPV, ROI, Cap Rate)

Calculate and interpret: • IRR • NPV • ROI • Payback Period • Cap Rate …exactly the way investors and banks do.

Valuation & scenario modeling

Apply: • DCF valuation • WACC • Exit cap rates • Scenario analysis to assess investment risk and upside/downside.

Model design & presentation

Design professional model layouts, dashboards, and investor-ready outputs that communicate clearly.

Investor mindset & decision logic

Understand how investors and banks think, and how real investment decisions are made.

Advanced cash flow and liquidity modeling

Analyze liquidity risk, funding gaps, and critical cash timing issues.

Advanced Revenue Phasing

Model real market behavior, phased launches, and repricing risk under different scenarios.

Cost overruns, delays & risk modeling

Analyze how construction delays and cost overruns impact cash flow, IRR, and equity returns.

Bank logic, DSCR & leverage control

Understand bank constraints, DSCR requirements, and how to control safe leverage levels.

Equity Waterfall & Promote Structures

Model LP / GP structures, including: • Preferred returns • Catch-up • Promote mechanics

Advanced sensitivity & downside analysis

Perform downside analysis to identify: • Break-even points • Capital at risk • Worst-case scenarios

Institutional model architecture

Design clear, auditable, institutional-grade financial model structures used by professionals.

Full real-life institutional case study (capstone)

Apply everything in a full institutional model from a blank Excel file to a final investment decision.

Who This Course Is For

Real Estate Investors

Financial Analysts

Real Estate Developers

Bank credit analysts

Meet Your Instructor

Instructor Mohamed Khalifa

- CMA®, FMVA® Holder

- Over 13 years of hands-on experience in finance

- 7,500+ trainees

What Students Say